Pricing in Commercial Insurance – 6 questions to ask of ourselves as underwriters

Over the past three years MAP Training have been engaged by several clients to help develop pricing skills in their underwriters. We have designed be-spoke training programmes for underwriters across a wide range of traditional and specialist commercial classes of business and through this extensive exposure have sought to understand the key issues for underwriters in pricing insurance. We have derived the following simple 6 questions which we believe all underwriters should be able to answer if their pricing approach is underpinned by a pricing model:

- What do I know about my pricing model and how can I find out?

- How good is my data?

- Am I double-discounting in pricing for risk management, quality of risk and claims experience?

- What am I giving away by using a commercial discount?

- Do I use gut-feel and am I subject to bias?

- Am I an inquisitive decision making underwriter or a machine part?

In this article, we briefly explore each of these questions

1. What do I know about the pricing model and how can I find out?

Whatever the form of the pricing tool used – a rate in a book, a simple spreadsheet or a sophisticated pricing model – as the underwriter I must understand the pricing tool and what the published rate/premium includes. Some questions to consider include:

- – What are the origins of the pricing tool?

- – How does it reflect corporate and underwriting strategy?

- – When were the rates/premiums compiled and how regularly is it reviewed

- – What are the components of cost?

- – What are the assumptions made?

- – What is in the published rate/premium and what isn’t?

Put simply – how can I make decisions on pricing risks and adjust pricing tool rates unless I know what is in the pricing tool rate/premium?

Most pricing tools have been derived by pricing teams and hence a close working relationship with underwriters is extremely beneficial (clearly in practice the importance of this relationship will vary by nature of class of insurance and size of risk). If as an underwriter I do not know what sits behind the pricing tool I am using – a starting point would be to ask the pricing team.

2. How good is my data and the standard of coding?

Insurance has been based on data since the very beginnings of the industry (in the Lloyd’s coffee house) and it is no different now that we have complex pricing models. A key question for us as underwriters is how accurate is the pricing tool I am using? This is often dependent on the quality and quantity of data it is based on (claims data, exposure data, trades, inflation, etc.). Reflecting on this question – this is always an essential discussion to have with the pricing team. Given this central role of data, the standard and accuracy of coding by underwriters, claims, and operations teams should be championed.

The revolution in data availability and processing capability currently occurring through the increase in new sources of data fuelling the internet, big data, artificial intelligence and machine learning also has a big impact on underwriting and pricing risks. I need to ask myself, “Where can I get new sources of data on this risk, on this account, for this portfolio, etc. to help me in pricing more accurately?”

3. Am I double-discounting in pricing for risk management, quality of risk and claims experience?

An observed common practice is that underwriters adjust pricing tool rates/premiums for favourable features specific to the risk being priced – such as risk management, risk quality (however defined) and claims experience. But where does favourable claims experience come from if it is not from favourable risk management or risk quality? Therefore am I “double-rewarding” a risk in terms of pricing adjustment by using a quality/risk management discount and in addition a favourable claims experience discount?

4. What am I giving away by using a commercial discount?

The premium required for a risk in order to make a profit should cover all the “components of cost” – namely claims, expenses, acquisition costs, reinsurance, taxes, cost of capital, investment income (positive gain) and profit. Put another way – if the pricing model being used is accurate, every time we use a commercial discount to reflect the competitive market conditions or to meet a desired target premium, we threaten the profitability of our book of business. Yet no insurer or no underwriter can hope to operate in the market without some ability to adjust premiums for competitive or strategic commercial reasons. What becomes essential is the understanding of the level of discount or adjustment compared to the components of cost – for example what element of which component am I prepared to give away and thereby what is my walk-away price or bottom line? Further, I understand that all cases need to contribute to the large loss funding within the claims component of cost. Then in addition to the impact on the individual risk, the underwriter should understand the impact of this pricing decision on the portfolio or book of business, plus the impact should be measured and monitored.

5. Do I use gut-feel and am I subject to bias?

Underwriting and pricing experience is to be valued – as underwriters we are developing this all the time and we all know an experienced colleague we look up to and learn from. But what if experience also leads to bias in our decision making and acting on gut-feel? All humans are in fact subject to bias (it is part of the way our brains work), so for example we tend to give recent events and personal emotive events far greater significance or weighting; we also tend to select data or information that support our already held views, or decisions we’ve already made, and conversely block out data or information that conflicts. The key to such biases and countering their potential adverse effects on decision making is awareness. Am I being unduly influenced in my pricing and the data I use by the broker’s target price?

6. Am I an inquisitive decision making underwriter or a machine part?

As an underwriter I take the pricing tool answer – either the rate from the book or the pricing model output – and quote this to the client. I don’t understand where this price comes from and have no interaction with my pricing colleagues who built this. I react to the competitive market by reducing premiums to match competitors and broker target prices. I input information to the pricing model and for policy record purposes to get an answer and to get the job done. I am a machine part!

Alternatively – I am an underwriter who champions data accuracy and am inquisitive about possible new sources of data to assist my underwriting and pricing. I am interested in current affairs, technology, other industries, etc. and am conscious of gaps in my knowledge and focus on self-development. I talk regularly to colleagues in the pricing team and understand how the pricing tools work and the assumptions the actuaries have made in building them. I know that two fellow underwriters from my team are working with the pricing team on the next review of the pricing model. In my class of business I follow an agreed pricing process formed around the size and complexity of the risk. I have authority to vary the pricing model price for agreed underwriting features with full documentation of the rationale for those pricing decisions, with any commercial adjustment decisions being made in conjunction with my manager.

Summary

If all underwriters could answer these 6 questions fully and use them to resolve the issues behind them – then pricing capability throughout the commercial insurance organisation could be transformed, and competitive advantage gained.

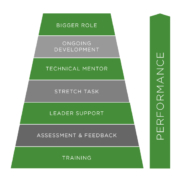

At MAP Training we have extensive experience in the development of technical competence in insurance – building structured programmes for underwriters (and other insurance roles). We also help organisations build skills and competency frameworks, assess technical capability, and design and deliver training and development programmes to help address capability gaps – and of late as described above this has involved assisting clients in transforming the pricing capabilities of their underwriters.

If you want to discuss this or anything else in this article please do get in touch at enquiries@maptraining.co.uk

pixabay

pixabay

Leave a Reply

Want to join the discussion?Feel free to contribute!