Six ways to develop an underwriter

- “Once in a blue moon”

- “It takes two to tango”

- “….is the straw that broke the camel’s back”

- “He who laughs last laughs longest”

- “that’s let the cat out of the bag”

And my personal favourite:

- “You could trot a mouse on that”.

The English language, as spoken, has thousands of sayings which enrich our ability to describe situations, people and processes – but which confuse those learning English as a second language. Try explaining to a Frenchman – “that’s put a spanner in the works” compared to “a fly in the ointment”, or the difference between “can’t see the wood for the trees” and “caught between a rock and a hard place”!

We are awfully good at complicating matters in insurance as well. Just look at our use of initial letters; sometimes I think brokers and insurers can only converse if they include an acronym in every sentence. There’s only one worse industry and that’s government – did you know that JSA, HB, UC, SMP, ESA, DLA (and many others) are all different benefits! But that’s another story.

Returning to Insurance – sometimes there is a pressing need to simplify matters and communicate in a straight forward fashion. The development of underwriters has become an industry in itself with our love in insurance of complexity. Each company talks of their own methodology of developing underwriters – but is it just talk, or do they deliver?

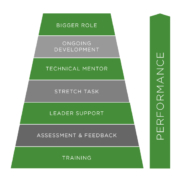

So to borrow another couple of English expressions in an effort “to get back to basics” and “sort the wheat from the chaff”, here are Six Ways to Develop the Underwriter:-

1. On the Job

The traditional way of underwriter development – by doing the job under supervision and by learning from more experienced practitioners. A job title from the past and the era of tariffs, dictaphones and carbon paper was Section Head; this role, usually filled by the most experienced underwriter who had seen it all before, was the focal point of on the job training and learning from the experienced underwriter. Lloyd’s operated a variation on the same system with assistant underwriters shadowing the Underwriter (in the Lloyd’s box).

Aside from the history lesson, this method of learning as an underwriter on the job remains the most important and most productive – people learn so much more efficiently and effectively by doing, rather than by merely listening, reading or learning by rote.

It’s just in today’s insurance world – few experienced underwriters seem to have the time, or perhaps more controversially the inclination or management encouragement, to devote resource and effort to bringing on the next generation of underwriters. Another factor could be that with the change in insurance company structures, for example in the separation of underwriting and operation roles, the experienced underwriters have fallen out of this learning practice or perhaps lack the training skills.

The role of the computer, rating engines, big data, etc. has also changed the training environment.

This is not to say that such training on the job does not take place in today’s world – it just feels more difficult to do and less successful – despite most training research showing this is the best way to learn.

- Training Courses (plus)

These obviously offer the chance for one experienced trainer/underwriter/practitioner to impart knowledge and practice to many delegates – traditionally in a classroom setting but increasingly in a virtual environment (webinars, online training, computerised assessments, etc.). Success of this method of underwriter development depends on many factors (refer previous article – The Chain of Destruction). What is clear is that learning achieved on courses and in the classroom needs to be embedded (the “plus” in the heading). Embedding simply means using or practising the new skills and knowledge immediately in the work place and back on the job. Line manager commitment to the training event and specifically in ensuring these opportunities for the trainee to use the new skill or knowledge take place is critical.

- Self-development

Underwriters, along with all professionals, are urged to take responsibility for developing themselves. Insurance employers pushing this line to go alongside their own drive to develop underwriters through on the job learning, investing in courses etc. is entirely positive, but one wonders in some cases if this current trend of making the individual responsible corresponds with a reduction in the employer’s commitment to this goal? That would be a negative and short sighted approach, when the employer has as much to gain as the individual from the development and therefore the improved capability of the employee. Certainly in our experience individual underwriters often struggle to identify their own needs development-wise, meaning that unsupported self-development is difficult. Coach the employee, provide support, guidance and development tools and self-development can take off and really complement the other ways of underwriter development.

- Professional Exams

An absolute necessity for professionalism, setting standards and qualifications, professional study and exams provide a bedrock of theoretical insurance learning. The underwriter cannot learn all the theory behind insurance through on the job training – this requires study, combined with two of the other ways to development – namely Courses and Self-development. The CII exams over recent years have become much more practical and case/example related – all extremely positive developments in what is the process of learning and applying insurance theory and practice. Continuous professional development (CPD) maintains that disciplined approach to learning and maintenance of knowledge through the underwriter’s career.

- Challenging Experiences

A new and challenging experience enables faster and deeper learning. This can be part of On the Job Learning – think: carrying out work beyond one’s own authority under supervision, plus Case Clinics where actual underwriting cases are used as examples, discussed in the team and used in practice environments.

In addition job swaps, secondments and job shadowing can take the underwriter out of their comfort zone and give them a new significant learning opportunity. The same can be achieved by involvement in corporate or strategic projects. One of the strongest examples is created by the underwriter becoming the teacher – by training others, the individual trains him or herself in preparation.

All these examples can also be used to embed learning achieved through the other ways looked at here.

- A Structured Programme

This is the most important way to underwriter development – the provision of a structured programme of development, combining the other 5 ways in a coherent plan. But structure should go far beyond the production of an individual’s training and development plan – it also needs to provide for the Company some answers to questions such as:–

- What underwriting capability do we need to deliver our business strategy?

- What is our current underwriting capability and where are the gaps?

- Will we be able to grow our own underwriters of a certain competency or do we need to recruit?

- How do we maximise our return on investment in training and development?

So the full structure (or infrastructure) involves – a capability framework, an assessment of current capability against that framework, a training needs analysis, programmes designed to fill those gaps and deliver for the business; plus training and development plans for individual underwriters. Implementation of those plans should involve on the job development, training courses, self-development, professional exams and challenging stretch tasks.

To sum up – “it’s not rocket science”, but there again “it’s not a walk in the park” and “the devil’s in the detail”.

At MAP Training we have extensive experience in the development of technical competence in insurance – building structured programmes for underwriters (and other insurance roles). We also help organisations build skills and competency frameworks, assess technical capability, and design and deliver training and development programmes to help address capability gaps.

If you want to discuss this or anything else in this article please do get in touch

pixabay

pixabay

Leave a Reply

Want to join the discussion?Feel free to contribute!