A Changing Market?

Questions for the Underwriting Director or Portfolio Manager

After a long period of soft and competitive conditions the UK insurance market – or perhaps more accurately sections of it – is hardening. This is being seen in Commercial Property, Energy, Marine, Professional Indemnity and other sections and classes.

How well insurers are positioned for this change can be assessed by some specific questions aimed at Underwriting Directors and/or Portfolio Managers.

The Questions

- – What evidence do we have that market conditions are changing and becoming harder?

- – Has my company, my division, my line of business a clear strategy for the hardening market?

- – How long will the hard (harder) market last and therefore what is the period of opportunity?

- – How do we measure our success in the hardening/hard market?

- – What are the implications of our brokers’ lack of experience of a hard market?

- – How do we deal with delegated authority, scheme, MGA and aggregator business in this changed market?

- – How can we educate our insured clients on the changing market conditions?

- – How do we communicate and promote the changed conditions?

- – How many of my underwriters have experience of working in a hardening/hard market?

- – Is a hardening market all about increasing premiums?

- – What knowledge and which skills do my underwriters need in the hard market?

- – How strong are my team’s relationship management skills?

- – Have we got the negotiation and trading skills to maximise the opportunity of a hardening market?

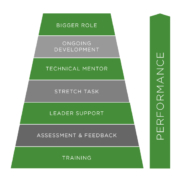

MAP Training

At MAP Training we have considerable experience in the development of capability in insurance, and have produced a training programme aimed specifically at developing underwriters’ ability to handle the changed conditions of a hardening market. This programme can be tailored to your specific business requirements over either a half day or full day workshop – if you like a “pick and mix” of subjects such as:

- – The market cycle

- – Pricing strategy for a hardening market

- – Portfolio strategy for a hardening market

- – Strategy over the entire cycle

- – Communication, negotiation and trading skills

- – Relationship management

- – The ability to communicate bad news

- – Dealing with reinsurers

- – Trading on different parts of the proposition

Because much of this material is already designed – we can offer competitive training rates for material and programmes tailored to your needs. If you are interested, please contact us at enquiries@maptraining.co.uk

Leave a Reply

Want to join the discussion?Feel free to contribute!